Contents insurance comparison: our ultimate guide

Our guide to understanding and comparing Contents insurance policies

When you first move into your new rental home, Contents insurance is one of those things that might not be on your mind straight away and can easily get put off. If you’re reading this, Contents insurance has probably come onto your radar- great! Whether you're not sure what policy you need, or you need some help with what to look out for when purchasing, this guide should help you find cover that’s right for you without any stress or confusion. This article focuses on Contents only insurance, as opposed to Buildings & Contents insurance (for homeowners and landlords). For a Buildings & Contents insurance guides head here.

Despite everyone in the UK having lots of belongings, in 2019 according to the ABI, only one in four households covered their Contents.

What is Contents insurance?

Contents only insurance (as opposed to combined buildings and Contents insurance), covers your possessions, from your clothes, to your kitchenware, to your electrical appliances. An easy way to think about it is to imagine tipping your home on its head. Everything that falls out and that you own is considered to be part of your contents, so this includes any freestanding fridges, bathroom cabinets, etc. Everything which stays in its place like flooring or the built-in-oven is part of the building. Contents insurance is usually bought by renters/tenants or leaseholders to cover only the things that they own.

Things which aren’t typically covered by your Contents insurance include anything which is owned by your landlord and anything which plays a structural role in your home, such as the walls or roof. This is usually covered by the landlord's homeowners insurance or 'buildings insurance'.

Do I need home Contents insurance?

This begs the question; do I really need home Contents insurance? The stats tell us that the majority of readers won’t have insurance, you may not have had reason to think about it before – so why now?

With Contents insurance, your possessions are covered against theft, fire, water damage and, you have the option to add on out of home cover. Plus, we include Tenants Liability cover as standard with our Urban Jungle Contents only policy.

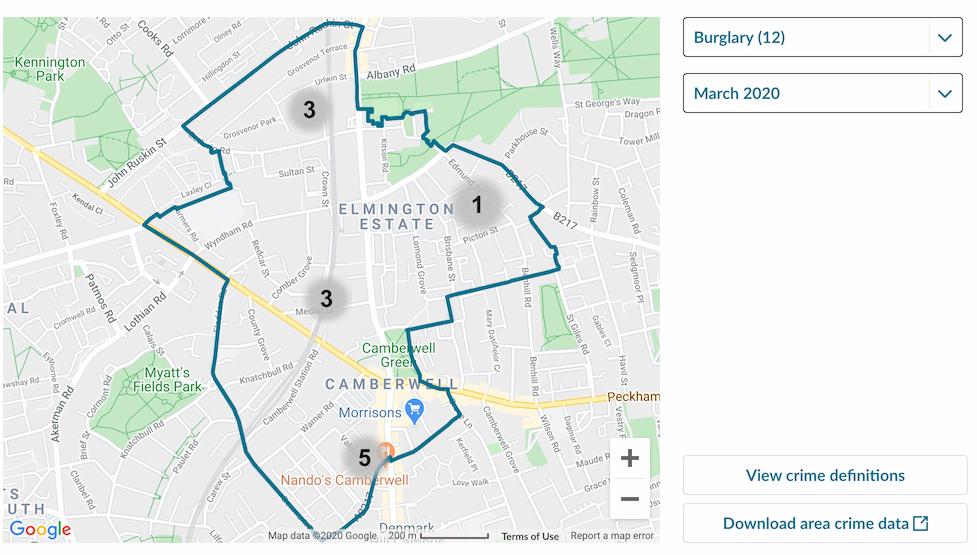

In 2017, 2% of UK households were victims of burglaries, rising to 3.5% in London. You can check what the burglary stats are like in your area on the police website.

In 2018/2019, there were just under 37,000 fires in people's home in UK households reported by the home office. Insurance or not, always make sure that you check your fire alarm is working regularly, make sure you always turn the hob off and be careful with open flames. You can check the stats on fires in your local area here.

In 2018, the Association of British Insurers records that water damage is one of the most claimed for damage among domestic property damage. This means that the biggest area of risk in your home will be the plumbing, so keep an eye on your boiler, any damp areas, and potential leaks from the roof.

Your options are; to get insurance, self-insure, or hope for the best. Self-insuring refers to putting some money aside, you'll need to be sure that you can afford to support yourself should the worst happen. Just think, if your house burnt down would you be able to buy everything new again? Would you be able to afford alternative accommodation while you wait for everything to be sorted out?

What does Contents insurance cover?

If you choose to go down the insurance option (we think that's wise but of course we're biased) you will now want to check you've got all the cover you need. We hear the question 'what does Contents insurance cover' very often and the three main things is if your home gets flooded, burnt down, or burgled. Urban Jungle's standard package covers for those and many more including:

- Fire & smoke

- Storms & floods

- Theft & vandalism

- Tenants Liability

- Household leaks

- Alternative accommodation

- Public Liability

Did you know that most people undervalue how much it would cost to buy all of their things again new? Some research suggests that on average, UK households are undervaluing their Contents by £16,000, that's a massive £115bn worth of Contents that could be undervalued across the UK.

Luckily, we have a post which helps you value your belongings, as well as a Contents insurance calculator which can help you work through your stuff. The cost of buying everything back isn’t the only thing to bear in mind, as things like staying in a hotel while you wait to move back in or find a new place can really add up.

Even if you’ve got a keen eye for a bargain, it’s going to end up costing you a fair bit to buy replacement clothes, your bike, laptop, phone, bedding or your precious camera collection? Our Contents insurance policies cover you for £10,000 per person as standard, and you can increase this to suit you.

Something that a lot of people don’t know about is the ‘averages clause’. If you’ve undervalued your belongings, even when the claim is for a small amount, the insurer can choose to reduce the payout. For example, say you’re insured for £25,000, but actually own £50,000 of Contents. Now imagine £5,000 worth of items are stolen and the insurer assesses your property, they’ll only pay out £2,500 in proportion to your cover level.

Is Contents insurance mandatory?

No, Contents insurance is not compulsory or a legal requirement while renting your home. If you own your home you may need to buy buildings insurance. See more details here.

Although contents insurance is not mandatory, it may be a good idea to protect your stuff from theft, accidental damage and loss. Ultimately, it's completely up to you.

What is an excess?

In case you didn’t know, an excess is a base amount which your claim has to be greater than in order for the insurance company to pay out. For example, if your excess is £250 and you claim for £1,000, then the insurance company will pay you £750. You will nearly always get the option to change your excess when you buy your policy, the lower the excess the more expensive the quote. Bear in mind that for some things there will be a compulsory excess, particularly for problems such as escape of water as it’s one of the most common claims made. You can read more about how excesses work here.

What should I look out for before buying?

Steep renewal costs: People are often lured in by discounts and ads for the cheapest Contents insurance deals and then caught out by steep renewal prices. A lot of the time, your renewal price may seem only slightly more expensive because the insurance company compares the new cost with your initial quote (before discounts were applied). If you look at customer reviews, then you’ll be able to get some idea of how much your premium may increase by come renewal time. In the traditional insurance industry, this is a common practice which we stand against. We believe that new customers should never pay less than our existing customers and value loyalty.

Costs for making changes: Similarly, getting the cheapest Contents insurance deal may charge you excessively for changing your policy. If you look for it, then you can find how much making changes will cost (as a general rule, if it costs nothing then it will be advertised proudly, and if it costs a lot then you’ll have to work to find it). Some insurance providers have complicated and long-winded changes procedures, which can involve spending hours on the phone, so watch out for that on the reviews as well.

Steep costs for expensive items: If you have any high-value items, then it could be worth getting a quote with and without them included to see how much they’re pushing up your premium – sometimes getting standalone insurance for something really valuable can be your best option.

Beware of interest: When looking at a Contents insurance comparison lookout for the providers who give you the option of paying in monthly instalments to keep your immediate costs lower. These can seem great in the short term, however, many of these insurance companies will also be charging you interest so it actually works out more expensive overall. Paying monthly and annually both have their advantages and disadvantages, so it’s really up to you what you do.

But – our Contents insurance policy can be pay-as-you-go from £5 per month. This means you keep your immediate costs lower without spending more in the long-term.

What's the best contents insurance for renters?

If you're looking for the best contents insurance for renters, the short answer is it really depends on your personal set up and what you need covered.

While there are some features which are nearly always included, no matter the provider, most policies will also have 'add-ons'. This means you can custom your cover by adding the extra cover you need, or not, meaning you won't pay for the cover you don't need!

Add-ons typically include legal expenses, out of home cover and home emergency. This is entirely up to you, and how necessary it is varies from person to person.

Legal expenses cover will usually pay for legal advice and/or going to court, check the policy wording to make sure the cover is relevant to you.

Out of home cover will include personal items that you would typically take out of the home with you on a frequent basis. This usually covers you against theft, accidental damage, or accidental loss. This would include items such as bikes or phones. It's always important to check the details around out of home cover, for example how to securely lock a bike.

Home emergency cover sounds dramatic, but it just means that should your boiler break or a pipe burst, your insurance provider will send someone over to fix it ASAP. This is, of course, very convenient, however if you live in a new house or recently had a new boiler installed then it may not be worth it. It’s also worth noting that this is most likely covered by your landlord’s insurance, so check with them if you can before buying anything.

If you want your landlord’s stuff to be covered (also known as Tenants Liability Insurance) then you’ll need your Tenants Liability Insurance to include accidental damage cover. We include Tenants Liability Insurance as standard at no extra cost as we know accidents happen, but some other insurers may not offer Tenants Liability Cover at all – so always check the policy document!

Contents insurance comparison - Urban Jungle Vs traditional insurers

We always recommend searching around to find the policy that suits you most, but if you don't fancy spending a few hours comparing Contents insurance we've laid out how we compare to a traditional insurer.

Urban Jungle Contents Only Policy

- Transparent prices starting from £5 a month

- 5 simple questions to get a quote

- Monthly rolling policy - cancel or make changes online 24/7 for free

- Referral rewards to give you and your friends discounts

- Flexible cover options Tenants Liability Cover included as standard

Traditional policy*

- Unpredictable prices and not designed for renters

- Endless questions you don’t know how to answer

- Annual contract means typically you’ll have sneaky price rises every year

- Have to call to make changes and admin fees are common

- Inflexible cover options mean you pay extra for cover you don’t need

*Based on a sample of alternative UK insurance providers. Experiences may vary and these may not apply for every traditional policy.

How much does contents insurance cost roughly?

According to the ABI, the average price of a Contents policy in 2019 was around £127 a year, but it will vary a lot depending on where you live, what your house is made out of, home security, and your claims history. For example, if you live in an area prone to flooding then your premium will be higher.

At Urban Jungle, our prices start at £5 a month for someone living alone, regardless of age or location.

Check out our guide 'How much does contents insurance cost?'.

Where can I buy contents insurance?

There are a few options when it comes to buying your Contents only insurance, and our advice will always be to look around until you find a deal which works for you. Remember – the best deal isn’t always the cheapest Contents insurance.

How to buy contents insurance - you can do this in a variety of ways – you could go onto a price comparison site like Compare the Market or Money Supermarket; you could go directly to a broker or financial adviser; or you could go and look at what’s on offer directly. If your goal is to find the cheapest Contents insurance out there as quickly as possible, then a price comparison site will help you do that.

What a price comparison site won’t do, however, is find the best value insurance. Comparison sites in the UK often also have many pages of questions to answer before you see any results, and the time spent filling in the boxes and then being redirected to buy your policy can mean that you don’t save much time at all.

If your goal is to get a great value policy quickly, we’ve worked hard to make our journey as quick and simple as possible. You can get a quote in 5 minutes, follow this link to get a quote.

As well as not saving you much time, comparison sites are often biased and will sometimes be sacrificing some policy features which you may want – so always check the small-print when you’re using them. Just because it might be the cheapest Contents deal it doesn’t mean that the cover is good, and could mean that you get short-changed. You also won’t be seeing any new insurance providers – there are a lot of new companies starting up which won’t be on comparison sites but could have better deals for you.

Tips for buying

Many insurance companies' main product is home or buildings insurance which you don't need as a renter or tenants as we noted earlier. They may sell Contents insurance for renters, in which case they may ask you some questions that renters couldn't possibly know the answer to, such as 'what percentage of your roof is flat or when was your house built'.

You can avoid all of these questions by getting a quote with us – we’ve cut them all out of our forms as we're specifically designed for renters and tenants. If not, our advice is to contact your landlord or lettings agent to see if they know. Information like build year will be very easy to find, whereas roof flatness and flooding history will be trickier which some landlords will still find it hard to check.

People are also often unsure of what to do about high value items. If you have any high value items, your policy will increase in price depending on the cover level you go for – if you only insure it at home then it will be cheaper than insuring it out of home. However, that doesn’t mean that insuring cheaper items out of home will bump up your premium that much. A £300 phone will make far less difference than a £5,000 ring.

Some insurance companies ask you to declare your ‘high risk’ items – these are things which would be particularly attractive to thieves, ranging from televisions to antique furniture. If you want these items to be covered, declare them – adding them doesn’t necessarily have any effect on your premium.

What happens after I buy Contents insurance?

A key factor in how attractive an insurance provider is, is how easy they are to deal with post-purchase. A lot of us will have heard nightmare stories about being on hold for ages before being charged £30 to change your bank details. It’s worth seeing if there’s a 24 hour phone service or chat option, or if there’s an online portal where you can make changes for free.

If you need to make a claim, the last thing you want is a complicated and stressful claims procedure. Most companies will have an explanation of the process in their FAQs, so have a look to see if there’s anything you need to know in advance. For example, most companies will insist on you going to the police within 24 hours if something is stolen in order for them to accept your claim.

How do I reduce the risk of needing to make a claim on Contents insurance?

Ah, the million dollar question! There’s no one answer, and for some problems, there’s literally nothing you can do. However, there are some things which will always reduce risks and could even reduce your premium!

First of all, make sure to always lock your door, if possible add deadlocks. If you’re in rented accommodation with poor or few locks, then we recommend that you put some new ones in. Ask your landlord first, and the chances are that they won’t have an issue (after all, they don’t want you to get robbed either).

Other simple things like knowing where the stopcock is will help you decrease damage should one of your pipes burst. You could even lower your water bills if you’re going away for a while and you have a leaky tap.

Speaking of holidays, it can be safer not to advertise that you’re going away too much. If you post about it on social media and tell a lot of people you don’t know very well, then the chances of a burglar hearing about it is much higher. Try to keep things on the down-low, and maybe also leave a light on while you’re away. We have a blog post on keeping your rental home safe while you’re away.

Finally, for those of you who enjoy a little tech, there are some smart devices you can get nowadays which are careful for you. A leak detector can be the only thing standing between a leak and a flooded house, and window sensors let you know if they’ve been left unlocked.

At Urban Jungle we offer specialised home Contents insurance, designed to fit in with renters’ lives. We noticed that the odds are often stacked against renters when it comes to insurance, so we’re making it as easy as possible for you to get insurance quickly, wherever and whenever suits you, which is why we’ve made our website 100% mobile friendly.

Are you a homeowner and need Contents and Buildings insurance? Check out our guide here.

You may also be interested in:

Claiming on contents insurance

How much does contents insurance cost?

Urban Jungle is not a financial advisor and information in this article should not be taken as advice or recommendation.